Almost everyone who dreams to own a home in Mumbai has to opt for a housing loan, given that the astronomical real estate rates in the city are more often than not generally way more than your savings! Buying a housing property in Mumbai does not come easy and cheap. Once you finalise on a neighbourhood and an appropriate size of an apartment well suited to you and your family, you have to look at the most important aspect of home buying—the cost.

I would say almost 90 per cent prospective buyers have to opt for a housing loan. Additionally, a housing loan also ensures the bank involvement in verifying that the property is clear of any legal issues.

There are a few things one should keep in mind before making such an important commitment:

1. Your total EMI (Equated Monthly Installment) should not exceed more than 40 per cent of your monthly income.

2. Compare the interest rate and check if it is floating or fixed. A floating rate is variable and mostly helpful, as the interest rates gradually go down.

3. Check if it is a repo-linked lending rate (RLLR). Many times, banks do not forward the interest-rate benefit to the borrowers. This new RLLR, on the other hand, will benefit borrowers as the bank will have to forward the interest-rate benefit as and when there are any changes.

4. Check if there are any pre-payment charges. No pre-payment charges makes the loan beneficial to you; try to make a lump-sum payment as and when you get any bonuses or extra profit from business, thus lowering on your interest expenses.

5. There is a tax benefit forwarded to home loans: you can deduct up to Rs 2,00,000/- u/s 24 towards interest payments and 1,50,000/- u/s 80c (this being the total amount which can be exempt under this section).

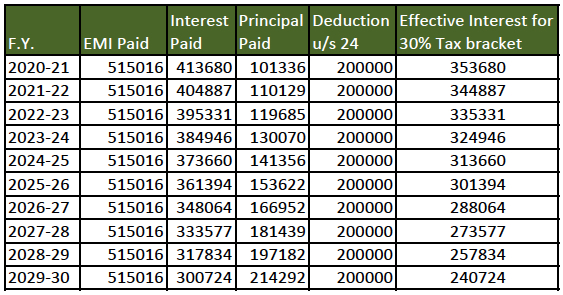

Let me illustrate the example in case of a Rs 50 lakh loan to be paid over 10 years.

Loan Amount: Rs 50,00,000/-

Loan Date: 1 April 2020

Tenure: 20 years

Interest rate: 8.35%

Your EMI will be: Rs 42,918/- (Approximate)

It is always better to make a informed decision.

Thank you

Anand Mhapralkar

Certified Financial Planner^CM

+91 9820663784

http://www.AnantWealth.com

Excellent. Keep it up.

LikeLike